Help us direct you to the right place to sign up

SKIP AHEAD TO:

Look at Starting and Net Effective Rents Instead [Plus Download a Free Template]

Office rent rates are obviously declining— there’s no doubt about that. The question is by how much exactly? Here is where relying on asking (and even just taking) rents can really do you a disservice.

In downturns, there is usually an increase in concessions, followed by a subsequent decrease in starting and net effective rents. The decrease in asking rent comes last.

This means two things:

- Concession data is the true indicator to watch when assessing the market’s true reaction to COVID or any other major disruptions, and

- This is exactly why you never ever rely on asking or even just taking rents. You need to know the net effective rent.

What is Net Effective Rent (NER) and How Does It Work, Exactly?

Here is a quick refresher:

Net Effective Rent is simply the rent that a lessee or sublessee pays once you “net out” all of the concessions made by the landlord or sub-landlord and average out the rent bumps.

Here’s an example:

Joe, a tenant broker, toured a space in Midtown that Michael, the landlord rep, showed him. The space is on the market at $70 a SF (per year) asking rent for a 10,000 SF space.

Joe’s client likes it, but Joe recognizes that this rent is much higher than the current COVID-devastated market for that kind of space.

Joe is an astute broker and Michael needs to rent his space for as high a price as possible so that the landlord’s investors are happy. Michael suggests to Joe that he put in an offer close to the asking rent, but includes lots of concessions to bring the overall rent per SQFT down.

Ultimately, Michael negotiates a 10-year deal for Joe in which Joe pays $65 a foot for the first 5 years and $67 a foot for the second five years. Joe will also get $75 a foot in Tenant Installation allowance, and ten months free rent.

Michael’s boss, the landlord, goes back to his investors and tells them that he made a deal with an average rent of $66 — not far off his asking price of $70.

However, let’s look at the Net Effective Rent:

The value of ten months free rent equals $5.42/SF

The value of $75 a foot in TI (Tenant Installation $) equals $7.50/SF

Net Effective Rent:

Average of $65 for 5 years and $67 for 5 years = $66 – $5.42 free rent – $7.50 TI = $53.08

Now, this is obviously a simplified model, as we didn’t account for the time value of money. If we did, you would find that the landlord did even worse. We also made the assumption that all of the free rent was up front, which is not always the case, and we assumed that the term wasn’t extended to account for the free rent.

We hope this shows the general principle behind net effective rent and how misleading asking and taking rents can be.

How to Find Net Effective Rent on CompStak

Approximately 75% of lease comps on CompStak have net effective rent, but this number varies on a market by market basis.

Why?

Unlike starting rent, which is a required data field for any lease comp we accept into the CompStak database, we calculate net effective rent based on a straight line formula using starting rent and concession data — but not all comps come with concessions.

What if the comp you are not interested in doesn’t have net effective rent?

You can still get the data you need by looking at other comps in the same buildings or in the buildings nearby. Most of these comps will have concession data, so you will still be able to make fair comparisons based on that.

How CompStak Calculates Net Effective Rent

There are different ways of calculating effective rent and CompStak is using two different methods, depending on the market: including or not including TI.

Calculating Net effective Rent Including TI:

|

|

Example:

Rent = 100

Free Rent = 12 months

TI = 100

Rent Bumps = $1 per year

Lease Term = 120 months.

Calculation:

1) Total rent paid over the term:

yr 1 = 100, yr 2 = 101, yr 3 = 102… the total is $1,045

2) Free rent: 12 months of free rent = $100 since it is 12 months in the first year. If, for example, it was 14 months then it would have been $100 from the first year + (2/12 * 101) = 116.83 Total rent – free rent – TI = 1,045 – 100 – 100 = $845 $845 * 12 = 10140 10140 / Lease Term = 10140 / 120 = $84.5

Additional notes:

When escalations are included in the comp, any starting rent, rent bumps or terms are ignored. The calculation is done from the escalations and the terms that are in the escalations.

When we have both rent bump in dollar and rent bump in percent, we calculate NER using the percent with the assumption rent bumps in both formats is not reasonable.

There is one exception to the rule above – “rent bump year.” This is most common in DC. In this case, the calculation involved increasing the rent in percent every year, other than the year indicated in the rent bump year. During that year the rent is increased by the rent bump in dollar.

How To Calculate Net Effective Rent Yourself [Spreadsheet Calculator Download]

Got some data outside of the CompStak data and need to calculate Net Effective Rent?

We’ve put together a working spreadsheet you can use to download — no strings attached and no email required!

Just click on the button below and get access to the spreadsheet.

It will be a View Only mode — just click file => make a copy and make this spreadsheet your own!

P.S. What Net Effective Rent Won’t Tell You

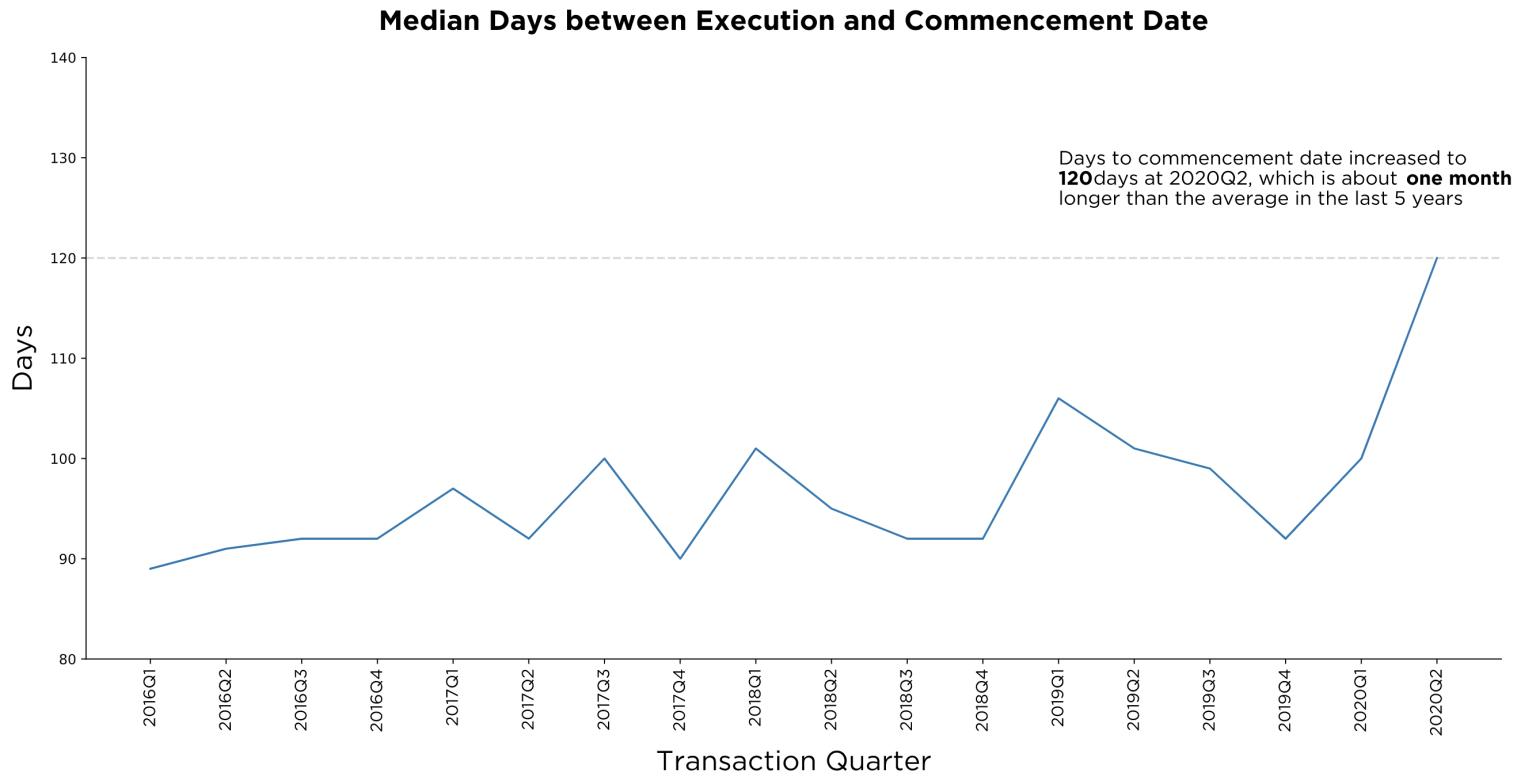

A month ago, the CompStak Data Science team noticed something interesting. In 2020, the median number of days between lease Execution and lease Commencement dates increased by a full month, to 120 days.

We’ve already seen concession increases and Starting Rent decreases in this market. However, in this particular downturn, we’ve discovered an entirely new concession – delayed commencement.

The side benefit to landlords is that delayed commencement doesn’t decrease Net Effective Rent.

Related Posts

The Importance of Transparency When Sharing Data: Podcast Recap