Help us direct you to the right place to sign up

2020 and 2021 have seen unprecedented market events in the CRE industry. The immediate aftermath of the COVID-19 pandemic saw leasing activity fall off of a cliff. Although recovery has been the broader economic story for H2-2020 and 2021, the CRE market has continued to lag behind. Even today, as many macroeconomic indicators like unemployment, GDP, and stock indexes have recovered and exceeded their pre-pandemic peaks, commercial real estate rents, most notably office rents, remain depressed relative to pre-pandemic averages. Is this the new normal? How should tenant and landlord reps navigate the deal landscape now in 2021 especially with the ample uncertainty that remains about the future direction of the CRE market?

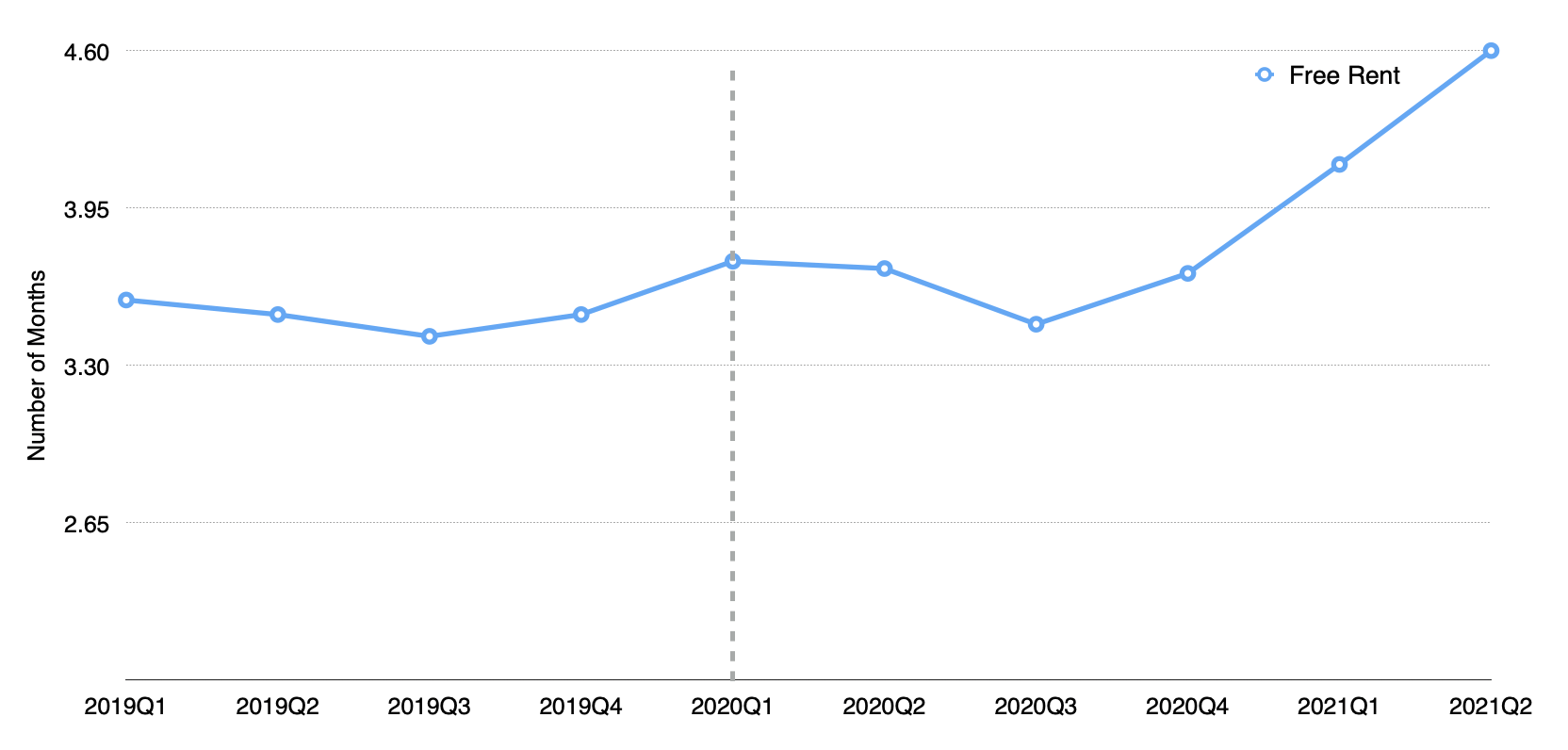

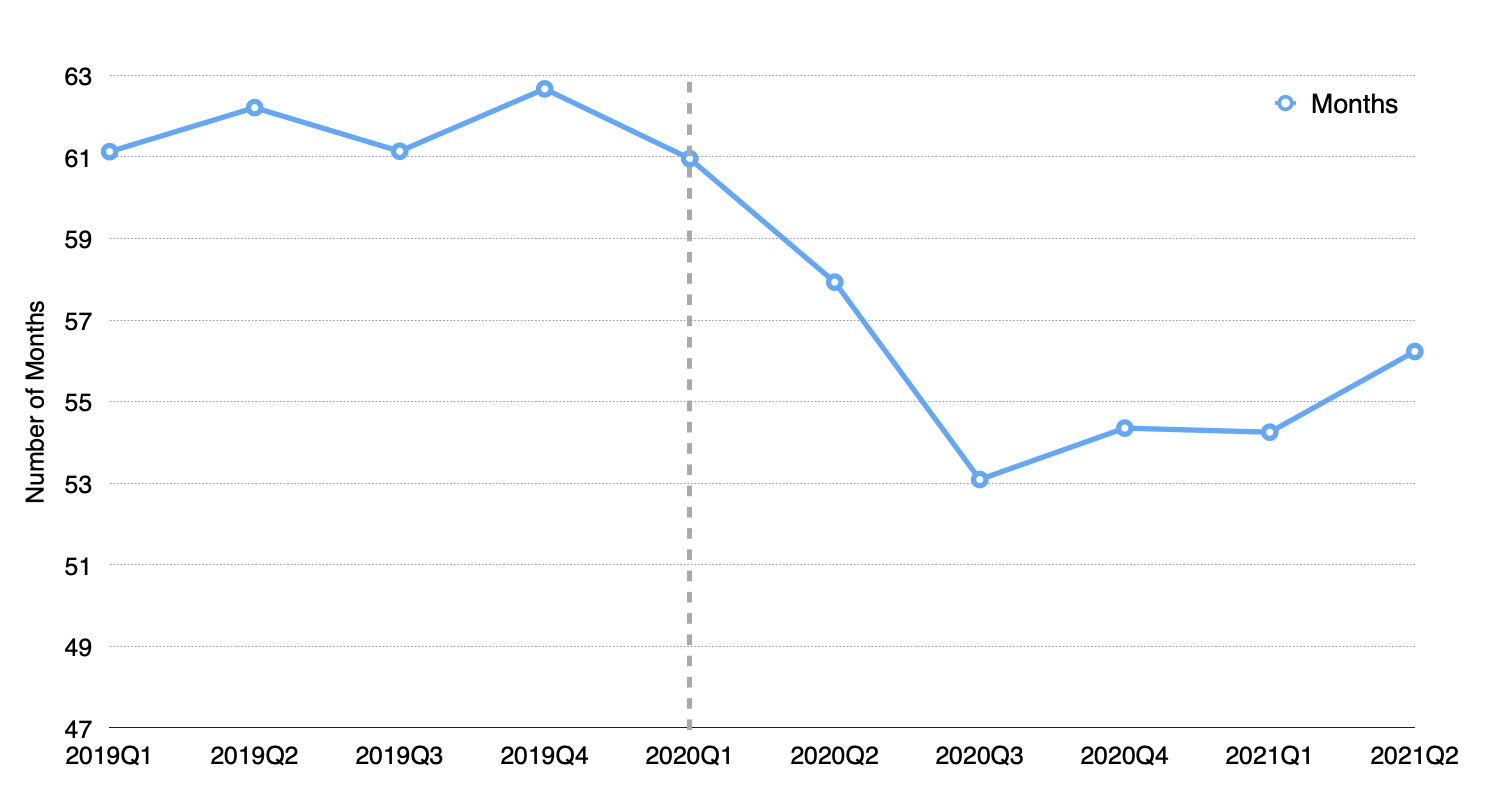

It is most definitely a tenant’s market today. Landlords are offering an unprecedented range and magnitude of concessions to coax tenants back to the office, including generous free rent and TI allocations. Bargain-hunting tenants have their pick of below-market office leases, sublets from newly remote companies, and small footprint hybrid arrangements. Tenants who signed leases in 2019 are feeling acute buyer’s remorse and tenants up for renewal in 2022 are driving a hard bargain.

What is the right call to make now? For one, the nature of office work has fundamentally changed forever. Many companies have opted for totally remote or hybrid in-person arrangements. Many employees, particularly millennials, are enamored with remote work, advocating for a future with lighter or non-existent office footprints. Offices themselves look to be changed for the foreseeable future with features like more square footage per employee, expensive high flow air filter systems, and other virus mitigation measures – a must as long as the threat of COVID variants remains. In the case of Amazon’s much-publicized HQ2 — Amazon execs admit that COVID has changed their workforce and what they want. The HQ2 future may include a more flexible, hybrid work environment as a result of the pandemic.

That said, offices are not disappearing anytime soon, and the current market conditions represent a unique opportunity for the savvy broker on both sides of the deal. In today’s market, tenant brokers should be trying to sign leases for as long as possible, and landlord brokers should aim to lock in short-term leases. Even an event as unprecedented as COVID-19 fits into a long history of cyclical and countercyclical trends in the market. If we look at recession trends in 2008 – 2010, the lease terms have gone down as well. The data proves that it benefits the landlord to sign short-term leases in the down market. Thus, as a tenant rep, it’s beneficial to encourage your clients to sign long-term leases in the down market as historically, the average lease term is longer than the length of the recession.

Similarly, people who come out ahead are usually those who are able to go against the grain and anticipate the next market cycle. A tenant who can lock in today’s unprecedented rates will look like a genius five years into their lease when they are paying dramatically below-market rents. A landlord that withstands cheap, short-term leases will be rewarded with the ability to sign a new lease in a reinvigorated market a few years down the road.

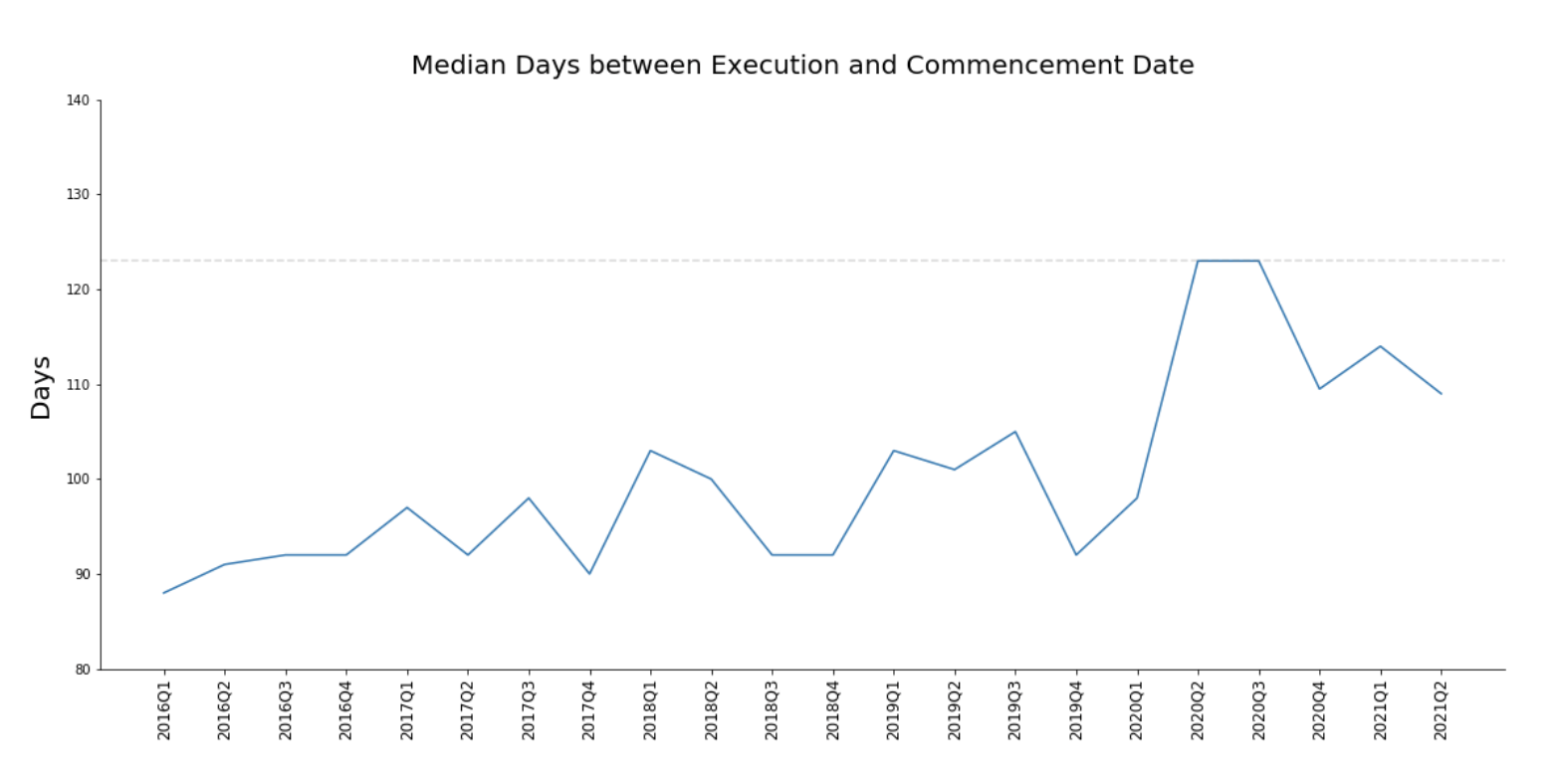

One more aspect of recent lease transitions to keep in mind is delayed commencement. Since the beginning of the pandemic, CompStak discovered a new trend, which allows tenants to sign a lease now and commit to occupying the space later. During COVID-19, the delayed commencement spiked to over 120 days, enabling tenants to lock a current rent for a future date.

In a way, everything and nothing has changed. Landlords and tenants are on the opposite sides of the spectrum. More than ever, it is critical to have access to verified impactful commercial real estate data to guide strategic decisions such as leasing. Join CompStak for access to the best-in-class platform so that you can navigate today’s uncertain CRE waters with confidence.

Related Posts

The Ultimate Guide to Concession Data Available on CompStak